2021 update

This article was originally published with our July 2020 newsletter, and has been fully updated following changes to the bank’s ownership in early 2021 (See our May 2021 newsletter for more details).

The article formed first part of a two-part review of the Customer Union for Ethical Banking’s second aim, to work for an eventual return of the Co-op Bank to full co-operative ownership. The second part of the series was published with our October 2020 newsletter, and discussed our strategy for advocating for a change of ownership.

The Co-op Group’s exit

To briefly recap the story so far, until 2013 the Co-operative Bank plc was 100% owned by The Co-operative Group. This is the cooperative that runs 80% of the Co-op shops. It is owned by its millions of customer members. However in 2013, the bank got itself into deep financial trouble and it became necessary to arrange a ‘bail-in’. This meant that the Co-operative Group's shareholding fell to 30% and a group of private equity and hedge funds took ownership of most of the rest.

This was the event that led to the formation of the Save Our Bank campaign, and later the Customer Union for Ethical Banking. We were set up with two main aims: to safeguard the bank’s Ethical Policy and help bring about a return to co-operative ownership. We believe that we have played a significant role in achieving the first aim. The second aim is much more difficult.

In 2017 the bank went through a second restructuring, during which the private investors were asked to put in more capital. As a result of this the Co-op Group sold all its remaining shares, leaving the bank 100% owned by private equity, including hedge funds. The only subsequent change of ownership we are aware of came in April 2021, when one of these investors, BlueMountain Capital, sold its stake in the bank (12% of ‘B’ shareholdings – see below) to JC Flowers and Bain Capital.

So - who owns the Co-op Bank now?

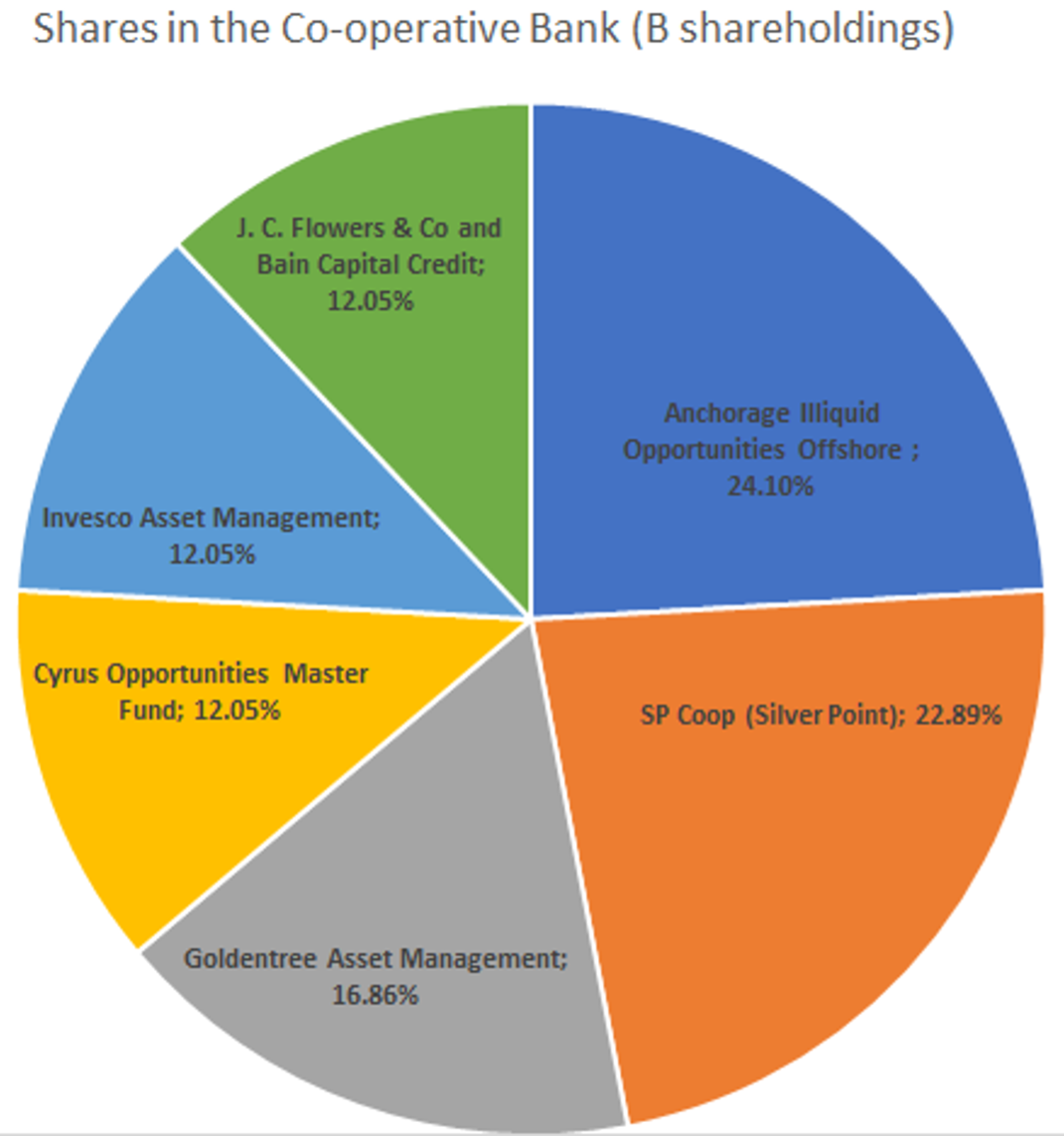

At first, when the Group sold its shares, it was unclear exactly which funds owned exactly how many shares. However since 2019 the bank has reported the full list of its ‘B’ shareholders its Annual Report. See the bank’s latest Annual Report here.

The bank allocates ‘B shareholdings’ to shareholders with over a 10% share in the bank’s normal shares, its ‘A shareholdings’. Only B shareholders have voting rights. The bank issues one B share to these eligible shareholders for every 1% of the bank’s ‘A shareholdings’ they own. Since the bank reports that it has issued 83 B shareholdings, we know these bigger shareholders own around 83% of the bank’s ‘A shareholdings’, and so smaller shareholders with no voting rights, probably including many individual investors, own about 17%.

(Note these are actually shareholders in a holding company, The Co-operative Bank Holdings Limited. This holding company owns 100% of the shares in The Co-operative Bank Finance plc., which in turn owns The Co-operative Bank plc.)

Following BlueMountain Capital’s sale of its stake in the bank to Bain Capital and JC Flowers, announced in April 2021, the bank’s ‘B’ shareholders in order of size were:

- Anchorage Illiquid Opportunities Offshore Master V.L.P (24.10%). Part of Anchorage Capital Group, a large US hedge fund with a focus on “operational turnarounds and special situations investments”, according to its website. Anchorage first invested in the bank in 2017.

- SP Coop Investments, Ltd (22.89%). This is understood to be a fund set up by Silver Point Capital [$13.6bn AUM] to manage its holdings in the bank. Silver Point is a US-based hedge fund, which the Guardian described in 2013 as “known for fighting hard when their investments run into trouble”. They have been one of the major investors in the Co-op Bank since 2013.

- Goldentree Asset Management Lux S.A.R.L. (16.87%). A Luxemburg-based subsidiary of the US investment firm of the same name. Goldentree manages money on behalf of pension funds, foundations, sovereign wealth funds and other large asset owners. It has also only been mentioned as an investor in the Co-op Bank since 2017;

- Cyrus Opportunities Master Fund II, Ltd (12.05%), Part of Cyrus Capital Partners, a smaller US hedge fund which emerged as an investor in the bank in 2017;

- Invesco Asset Management Limited (12.05%), the UK arm of a large mainstream US investment management company with branches in 20 countries and holdings in companies globally. Invesco is one of the original 2013 investors in the bank;

- J.C. Flowers & Co and Bain Capital Credit (12.06%) are two US private equity funds that are understood to hold their shares in the bank jointly. J.C. Flowers invests exclusively in financial services companies, listed on its website. In 2010 it was involved in the rescue and demutualisation of Kent Reliance building society, which led to the creation of OneSavings Bank. Bain Capital Credit is a US-based buyout firm with investments in a range of sectors. Its founders include Mitt Romney - as a result of which its strategy, frequently described as “looting”, has come under some scrutiny. Bain Capital has recently been involved in the proposed demutualisation of Liverpool Victoria.

There are other firms that were listed as investing in the bank in 2013, which have apparently sold up their stakes and moved on – Perry Capital Management, Beach Point Capital Management, Caspian Capital, Canyon Capital Advisors and Monarch Alternative Capital and York Capital Management are some of the names that were reported. We don’t know if these companies made any money on their investment.

A word on hedge funds

A hedge fund is a kind of investment fund which is typically only open to very wealthy investors. The term “hedge fund” comes from the idea of “hedging risk” (or “hedging your bets”); i.e. protecting yourself against risk by investing in areas that tend to compensate each other. But arguably this has become a misnomer: hedge funds are no longer focused on reducing risk – they tend to pursue high-risk investment strategies to maximize profits.

Hedge funds don’t have a great reputation – they often use tax havens (like Luxemburg and the Cayman Islands, mentioned above), and are lightly regulated with limited transparency. Several of the above listed funds have also been linked to major donors to the US Republican Party in reports by Ethical Consumer magazine.

Not all of the bank’s investors are hedge funds, although the two largest, Anchorage and Silver Point, are. Others, such as Invesco, Goldentree, J.C. Flowers and Bain, are mainstream asset managers or private equity funds, which tend to work for a wider range of clients including pension funds and governments rather than just a select group of millionaires. However, we don’t have any favourites among these investors - none of them are co-operatives, and a return to co-operative ownership is what we seek.

What’s likely to happen next with the Co-op Bank’s ownership?

We don’t expect the Co-op Bank’s owners to stick around for ever, although some of them have been invested for more than seven years – longer than we might have expected in 2013. Rumours of the bank’s potential sale to mainstream lenders have surfaced several times; for example in December 2019 Sky News (a regular source of Co-op Bank related leaks) reported that the bank’s owners had hired Goldman Sachs to advise on a potential sale of the bank. The story said, “Barclays, Lloyds Banking Group and Royal Bank of Scotland are said to have been among those approached about a deal.”

A sale of the Co-op Bank to a large mainstream bank is likely to be a threat to the integrity of the bank’s Ethical Policy. If the bank’s balance sheet were to be absorbed into that of the new owner, its ethical stance on avoiding ‘unethical’ business (as determined by customers’ concerns) would be lost. However, the bank’s owners, and most likely any future buyers, know this would damage the bank’s uniqueness and lead to an exodus of some of its customers – damaging the bank’s value.

As a Union of customers concerned about the bank’s ethics and ownership, we’re determined to do whatever we can to avoid any sale that would undermine the bank’s ethics, and to encourage the current owners to ensure a return to at least partial co-operative ownership. We’re under no illusions about how difficult this might be.

In the next part of this review we’ll discuss in more detail what might happen next, and our plans for what we see as the most likely scenarios.

In any case, as a co-operative ourselves, we’ll make sure to consult with our members on what happens next.

1. The Co-operative Bank pointed out to us that we got our A and B shareholders mixed up in the original version of this article. All shareholders have 'A' shares. Those with more than 10% have 'B' shares. Thank you to the bank for this.

info@saveourbank.coop

info@saveourbank.coop @SaveOurBank

@SaveOurBank @saveourbank

@saveourbank