The Cooperative Bank has announced Q1 2020 trading results.

we are providing payment holidays for approximately 17,000 mortgage, loans and credit card customers to date

Headlines are:

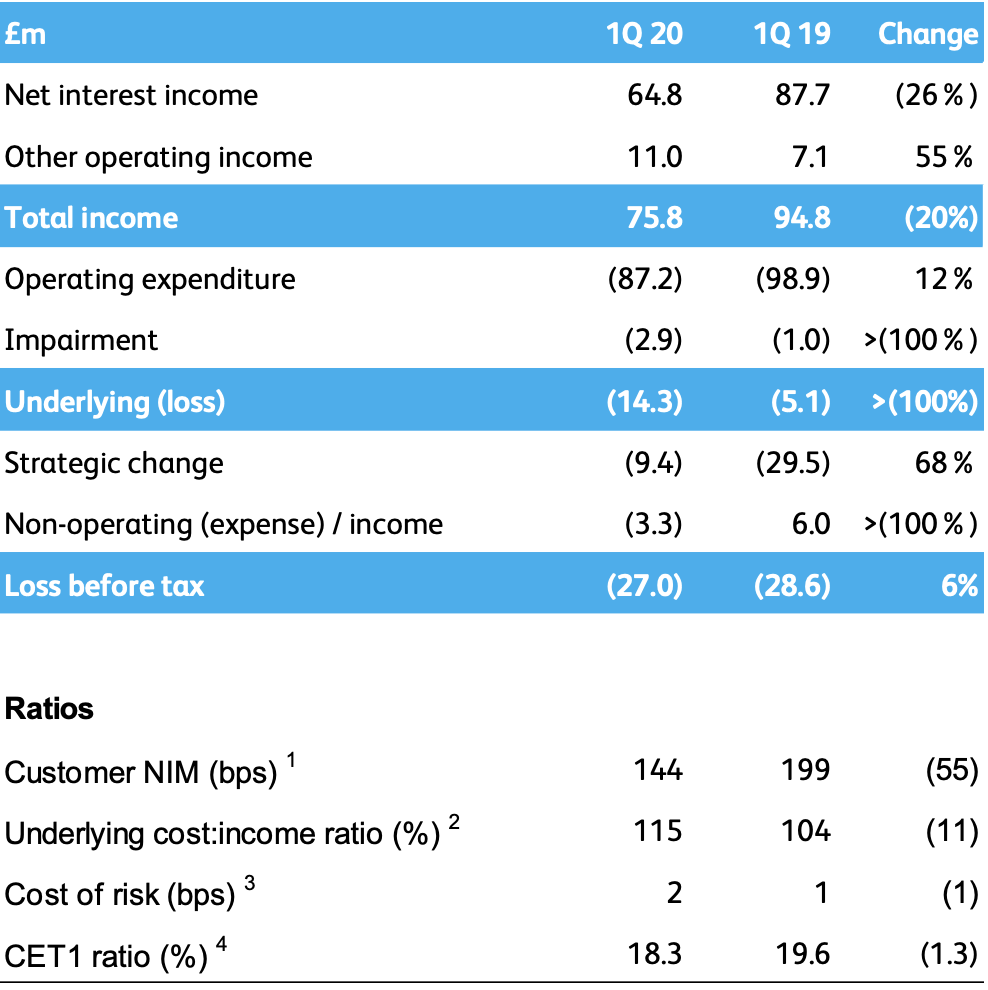

- Still losing money (operating loss before tax £27m) but down on Q1 2019

- COVID-19 impact of £12m

- Focus on customer support during COVID-19

- Branches and call centres all remain open

- SME business up with deposits up 11%

- Tier 1 capital ratio well clear of regulator requirement

- Net Interest Margin (NIM) down to 1.44%

Drawing attention to the support provided to customers, CEO Andrew Bester said:

"...All of our branches and contact centres have adapted and are open to serve customers safely throughout this period and we are providing payment holidays for approximately 17,000 mortgage, loans and credit card customers to date..."

Following a question from one of our members, it's interesting to note that the Net Interest Margin is down - the bank is taking a hit from the lower interest rate environment.

You can see the full statement here.

You can see the investor presentation here.

info@saveourbank.coop

info@saveourbank.coop @SaveOurBank

@SaveOurBank @saveourbank

@saveourbank