Welcome to this March newsletter from the Customer Union for Ethical Banking, the independent union for customers of The Co-operative Bank.

This month’s newsletter focuses on our view of the bank’s new Sustainability Report, as well as the latest update on Coventry Building Society’s bid to buy the bank.

Coventry Building Society hires JPMorgan as deal to buy Co-op “nears”

Coventry Building Society made a bid in December to buy the Co-operative Bank, and entered exclusive merger talks later the same month. We talked in our last newsletter about the reasons for our positive view of this potential merger, which would return the Co-op Bank to mutual ownership, and what it means for our work.

In a new development, earlier this month Sky News reported that Coventry had hired US banking giant JPMorgan Chase to advise, in advance of the exclusivity period expiring at the end of this month. We take this as a sign of Coventry’s seriousness about the purchase.

Our view of the banks’ Sustainability Report

The Co-op Bank released its Sustainability Report for 2023 at the end of February - you can read it here. As part of our mission to hold the bank to account on its ethical promises, we review the report carefully each year. Here are our key take-aways.

The Co-op Bank released its Sustainability Report for 2023 at the end of February - you can read it here. As part of our mission to hold the bank to account on its ethical promises, we review the report carefully each year. Here are our key take-aways.

Progress on measuring emissions

Last year the main news from the bank’s Sustainability Report was its new commitment to reach “net zero” in its financed emissions by 2050 - a commitment that we pointed out was not only overdue, but also fell short of a leadership position among UK banks.

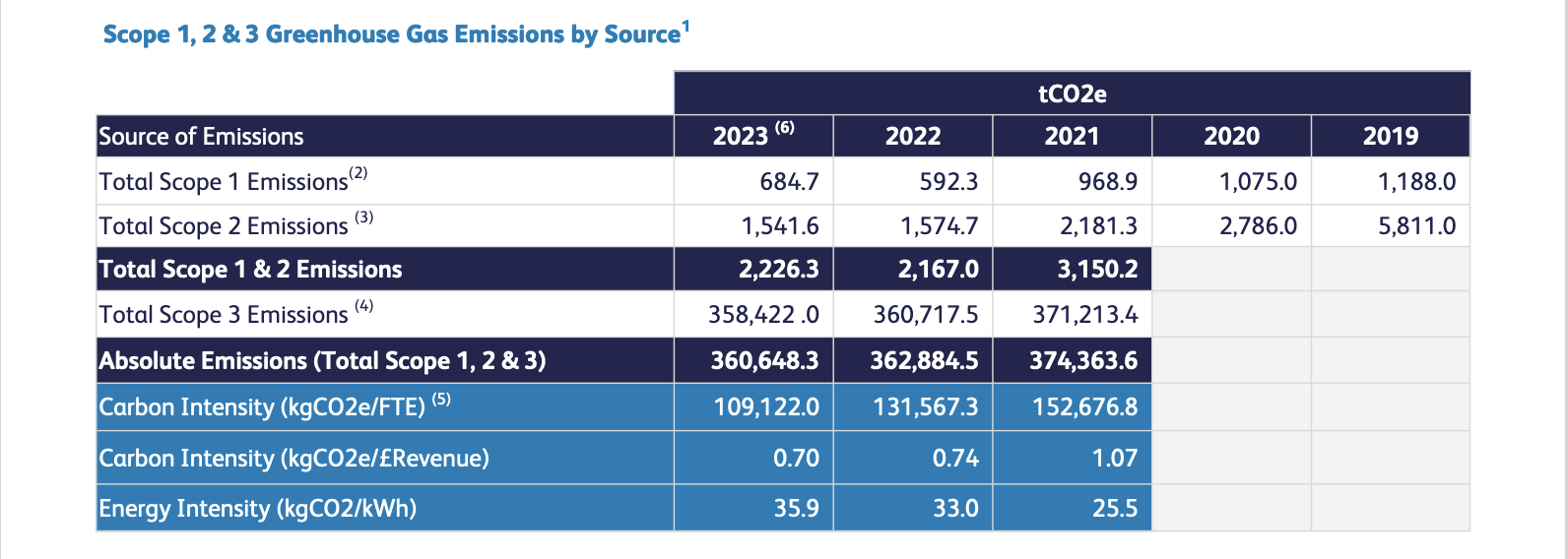

This year the Co-op has moved a significant step further by quantifying all its emissions, including its financed emissions, and having the data audited to ensure its accuracy. It’s hard to compare these amounts (360,648 tonnes of carbon dioxide equivalent in 2023, or 0.7 kg of CO2 per pound of revenue made) with other banks, but the point is to set a baseline against which the bank can move towards its net-zero goal.

See page 9 of the report for this emissions table

However there’s a lot further for the bank to go. A commitment to reach “net zero” by 2050 should be accompanied by strong interim targets (such as a 50% cut by 2030), because the bulk of the work of reducing emissions must happen soon, not in twenty or more years’ time. And ideally we’d like to see the bank scale up its ambition and set a deadline much sooner than 2050. The bank has a 2024 target to “commence development of a robust Net Zero Transition Plan”, so we look forward to more progress in the coming year.

Nine ethical policy declines

In 2023, the Co-op declined nine businesses for ethical policy breaches, including:

- One clothing company, for labour rights reasons

- One media organisation, with content that was considered to incite hatred

- One company working with organisations owned by oppressive governments

- Three business in the oil and gas sector, for climate reasons

- Two business with a negative impact on biodiversity and the environment

- One business for irresponsible gambling.

(See page 19 of the report for the bank’s slightly more detailed explanation).

These details always give interesting insights into how the bank’s ethical policy works in practice. But as we have said in previous years, we would like to see the implementation of the ethical policy fully audited, as it was before the bank’s crisis years, so that we can be assured that it’s being done properly and consistently. The bank’s ethical screening has not been subjected to independent third-party scrutiny since 2012.

Other details that caught our eye:

The bank has removed a target for “ongoing investment” in the renewable energy sector, and no longer reports its lending to the sector year-by-year. We would like to see a plan for the bank to reverse the ongoing decline in its renewables lending. Also - why is the bank giving itself a green tick (for “we’re in a good position on this metric") for its performance here?

The bank’s energy supplier discontinued its green tariff, which “has meant the Bank could no longer ensure that energy procured was sourced from renewables.” Work is underway to address this in 2024.

The Co-op Bank is now reimbursing mortgage-holders that were overcharged in the period 2009 to 2012 by its subsidiary Mortgage Agency Services No.5 (MAS5). The Financial Ombudsman Service said the bank “treated customers unfairly” in the rates that were charged. However you wouldn’t know this from the bank’s Sustainability Report, which doesn’t mention the issue at all.

We’re pleased to see a strong emphasis in the report on its campaigning work, including pushing for new legislation on two fronts: the Renters’ Reform Bill, to reform the housing rental market and stop no-fault evictions; and the Climate and Ecology Bill, for a joined-up approach to these two global emergencies. There’s much more good stuff besides, including continued funding for The Hive, growth in the number of accounts for co-ops, impressive employee volunteering growth, and continued involvement with Amnesty’s Write for Rights campaign.

Other Co-op Bank news

Two other pieces of news that might be of interest this month. A piece in the Financial Times (£) shows a “huge disparity” between the performance of different banks when setting up lasting power of attorney. The Co-operative Bank scored the worst out of the 16 banks assessed for “ease of registering”, while the best was … Coventry Building Society. We hope the Co-op will take action to make this process easier.

And BirminghamMail.co.uk works out that savers who put aside the maximum £250 each calendar month can earn up to £114.21 in a year in interest, with the bank’s new Regular Saver account. Information we thought worth sharing!

With best wishes,

The Save Our Bank team

That’s all for this month’s newsletter; thank you as ever for reading and supporting the Union.

With best wishes,

The Save Our Bank team

Have you joined the Customer Union yet? It costs £15 a year to be a member of the first ever customer union co-operative, and help us ensure the Co-op Bank sticks to its principles. It only takes a few moments to sign up here.

info@saveourbank.coop

info@saveourbank.coop @SaveOurBank

@SaveOurBank @saveourbank

@saveourbank